What is Fiscal Memory Device?

Recently, many countries are vigorously promoting fiscal memory devices, to strengthen the tax regulation of cash transactions. What is the fiscal memory module, and why should increase the fiscal cash register?

What is a fiscal memory device?

Fiscal memory devices are electronic devices used for arranging of a country's tax revenues. This equipment is currently widely used in many countries, including Kenya, Kenya, Tanzania, Malawi, Bulgaria, Serbia, Romania, Republic of Macedonia, Albania, Poland, Moldova, Bosnia and Herzegovina, Kazakhstan, Armenia, Georgia, and Ethiopia. Fiscal memory devices have the following categories:

1. electronic cash registers, fiscal cash registers

2. printers, fiscal printers

3. E-Signs, Electronic signature devices both of which contain fiscal memory.

And Fiscal memory itself is a kind of memory that is generally certified by an appropriate government body.

Why join the fiscal memory devices?

In order to control the grey economy and avoid retailer's frauds, Occasionally, governments enforce fiscal laws that require all taxpayers who generate sales from goods and services to record and use an approved fiscal cash register. Countries implement such laws to make tax collection more efficient and manageable. As a result, taxpayers are obligated to submit a receipt for their sales revenue. The law may also require all manufacturers to include pre-defined features in their cash register software. Below are just a few examples of common fiscal cash register requirements.

1. A serial number for each transaction

2. The name, address and the Value Added Tax identification number of the supplier

3. The Value Added Tax identification number of the person to whom the supply is made

4. A description sufficient to identify the goods supplied

5. Each description, the quantity of the goods, the tax rate chargeable, and the price payable, including the tax

6. The total amount of tax chargeable

What is the requirement of general fiscal memory device?

A fiscal memory device, such as the Cash registers, generally undergo extensive tests and scrutiny before the government certifies that it meets fiscal law specifications. Fiscal cash registers are tills that meet these specifications. They are specially equipped with fiscal memory, fiscal screw plus seal, and the capability to simultaneously print receipt copies containing all sales data as well as the data appearing on the customer rolls. Further, they must have 2 displays – one for the operator and one for the customer. Often, business owners using a fiscal cash register may (with permission of the tax agency) issue a generated sales tax invoice that satisfies the government’s fiscal stipulations.

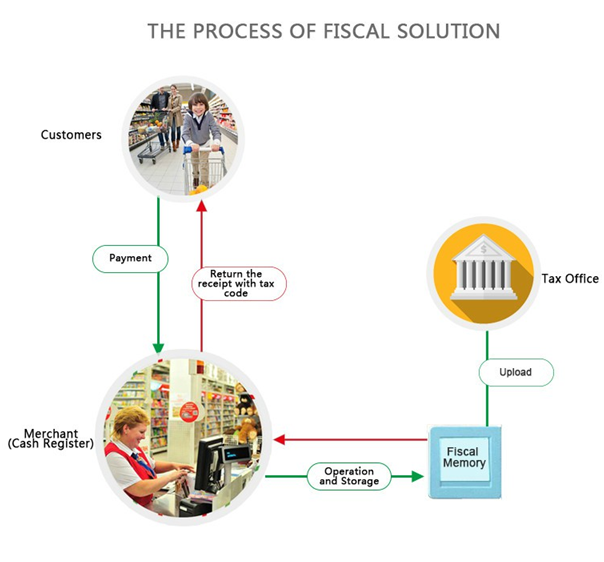

What is the general workflow of tax control?

Fiscal memory is installed in ECR or POS as a build-in module. It will automatically record the transaction information and send to tax bureau's server. Tax bureau will manage tax info via the data. At the same time, the printer will print a ticket with QR code, which allows the consumer to scan and check tax information.

Where to buy fiscal memory devices?

Telpo, like a China leading pos manufacturer, provides a complete set of fiscal solution.

Keywords: Fiscal memory devices, Fiscal memory, fiscal cash register, fiscal pos, electronic cash registers,fiscal printers, fiscal ecr, tax collection, tax control, fiscal solution, Telpo ODM, Telpo, tax registration, tax record, fiscal module, pos system, pos machine, pos terminal, telpo odm pos, pos solution